What is TDS?

TDS or Tax Deducted at Source is an income tax that

is reduced when a certain payment like rent, salary, commission, interest,

professional fees, etc. is made by the person who made such a payment. As per

the Income Tax Act, any company or a person is required to deduct tax at the

source itself if the money paid exceeds a certain amount. The person who

receives a payment also has a liability to pay tax.

The purpose of TDS may have been to reduce the

chance of evasion by the recipient of the incomes. But, for an honest taxpayer,

it also brings a few benefits.

Types of TDS

Even when you are making payments as an individual

taxpayer, you need to deduct TDS on certain payments. The following type of

payments that attract TDS:

a) Salary Transfer

b) Professional Fee

c) Consultation Fee

d) Rent Payments

e) Commission

f) Interest on Securities & Deposits

g) Dividend on company shares and mutual funds

h) Lottery and similar winnings

i) Payment of Royalty

What is a TDS Return?

You make the payments to other

parties against their services throughout the year. If these payments to one

party exceed the specified limit for the payments made under sections 192 to

195 of the India income tax act, you must deduct the applicable TDS

amount.

You will need to deposit the deducted TDS amount

quarterly along with the respective TDS Return. Depending on the nature of

payment (applicable section) you will file a separate TDS form as TDS Return,

each quarter.

Example of Tax Deducted at Source

TDS has to be deducted at the

applicable rates only. For example, the TDS rate on rent to resident

individuals and HUFs by resident individuals and HUFs is 5%, when the rent is

more than Rs 50,000 p.m.

Thus, if you are living in a rented house and

paying Rs 70,000 per month as rent, you should deduct Rs 3500 per month as TDS

before paying the rent. You will need to pay Rs 66,500 to the property owner

and will deposit Rs. 10,500 every quarter to the CBDT as the collected TDS

amount.

Similarly, a firm may deduct TDS on the fees

payable to a consultant for the professional services at 10%.

How Does TDS Work?

TDS would apply to all taxable incomes except it’ll

be deducted at source at a fixed rate. For almost all payments except salary,

TDS rate depends on the type of income rather than the amount of payment.

In the case of salary, the employer can estimate

the total expected income of the employee. Thus, TDS deduction happens at the

applicable slab rate and may change in the middle of the year based on:

1. Changes to income due to bonus,

appraisal

2. Submission of investment proof

Pro Tip: With salary TDS deduction a lot of employed

taxpayers fail to prepare. These taxpayers end up losing a big chunk of their

salaries in the last quarter of the financial year.

So, start your Tax saving

investment in April itself, and keep your TDS deductions higher in the

beginning. Thus, you will avoid last moment rush for tax saving investments and

income loss both.

When should TDS be deducted and who

is Liable to deduct it?

Any person including an individual, HUF (Hindu

Undivided Family), firm and NRI (non-resident Indian), is expected to deduct

tax at source, and provided:

1. The payment falls under the specified categories

defined under sections 192 to 195 of the Income Tax Act

2. The amount exceeds the limits specified for such

payments as per the CBDT circular for the assessment year

Following are a few payments when TDS must be

deducted by the pay or:

1. Payment of Salary

2. Interest payment on debentures and other securities

3. Dividend payments

4. Lottery winnings, prize money, etc.

5. Commission income

6. Consultation & Professional fee

7. Rent on building (only when exceeding Rs 50,000 p.m.)

8. Payment to NRI on any investments

9. Payment to contractors / vendors

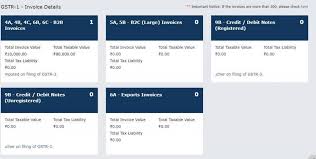

How and When to File TDS Returns?

TDS Rates for Various Regular

Payments

How to File TDS Return online?

You will need a TAN or Tax

Deduction & Collection Account Number to file a TDS return. Follow the

process below to file your TDS return online:

1. Register your TAN number for

e-filing

2. Prepare your TDS return using one of the online portals. You can log in to

the incometaxindia.gov.in to generate a TDS payment challan

3. Log in to the net banking and pay the collected due TDS amount

4. You can use a valid DSC (Digital Signature Certificate) to e-file and verify

your online TDS return

While filing TDS you also need the PAN and bank

account details of the payee. If the payee’s PAN is linked with Aadhaar you can

upload your returns using Electronic Verification Code (EVC).

How to Apply for a TDS Return?

The party deducting the TDS can issue

a TDS certificate in the applicable Form 16. The deducted TDS amount is

reflected in Foam 26AS as Tax Credits for the payee (person receiving the

amount after TDS deduction).

If you want to claim a TDS return you will need to

file your ITR for the assessment year (AY). The applicable credits are adjusted

out of your tax payable for the AY. If eligible for a refund, the same will be

processed and credited to your bank account within six months.

In case, where the deducted TDS amount does not

show up on your Form 26AS, you will need to submit the TDS certificate received

from the detectors.

What happens after TDS Deduction?

After TDS deduction the person or firm deducting

the TDS needs to deposit the same with the central government. Once deposited

the same will reflect on form 26AS of the person who received the income after

TDS. All the TDS payments reflecting on your Form 26AS will be automatically

adjusted in your taxable income.

The payor should also give you a TDS certificate

which you can alternatively use while filing your ITR. Yes, you do need to file

your personal ITR even after TDS deduction.

All the deducted TDS gives you tax credits and

reduces your tax liability.

So, for example, if you end up paying

30% TDS on a lottery payment of Rs. 300,000 (i.e. you received only Rs.

210,000), and this is your only income in the financial year, when you file

your ITR your total tax liability would be zero (Rs. 250,000 being the

minimum exempt income). Thus, the excess tax you ended up paying as TDS would

be returned to you.

Thus, don’t miss filing your personal ITR,

especially after TDS on any of your income.

What if you end up Deducting TDS?

The taxpayers, who are liable to deduct TDS on the

payments they make to others, need to file a quarterly TDS return. Filing TDS

return is mandatory if you are deducting TDS.

You need to file TDS return on Forms 24Q, 26Q, 26QB

or 26QC based on the purpose of TDS deduction each quarter and deposit the

deducted amount with CBDT. The return must be filed with the PAN/TAN of the deduct

or (payor) and PAN/TAN of the deductee.

Filing TDS return will ensure that the deductee’s

Form 26AS will be automatically credited.

How does TDS benefit you?

TDS payments, as we have already seen could be a

temporary deduction if your overall tax liability is less than the TDS amount.

However, if your income falls in the highest tax bracket, TDS will keep the

pressure off your pockets at the end of the year.

Advance Tax Paid On Income

Will reduce your tax liability at the

end of the financial year. Thus, helping you avoid payment delays and

penalties.

.jpeg)