What is GSTR-1?

Form GSTR-1 is a return statement in

which a regular dealer needs to capture all the outward supplies made during

the month or a quarter. In simple words, GSTR-1 is a return in which details of

sales and other outward supplies needs to be captured.

While GSTR-3B is a monthly

self-assessed return, you need to file GSTR-1 with outward supplies details

that substantiate the liability declared in GSTR-3B.

GSTR-1 due

date

The due dates for GSTR-1 are based on the turnover. Basis the

business turnover, GSTR-1 returns needs to be filed either on the monthly or

quarterly basis.

Businesses with turnover of up to INR 1.5 crore will be allowed to file quarterly return other businesses with a turnover of above INR 1.5 crore must file monthly returns.

GSTR-1 Form

and Format

Form

GSTR-1 is a statement in which a regular dealer needs to capture all the

outward supplies made during the month. Broadly, the GSTR 1 format requires -

all the outward supplies made to registered businesses (B2B) to be captured at

invoice level, and supplies made to unregistered business or end consumers to

be captured at a rate-wise level. However, in certain exceptional scenarios,

even B2C transactions are required to be captured at the invoice level.

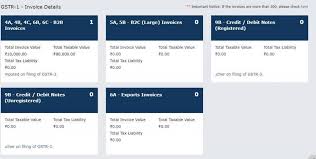

Form

GSTR-1 contains 13 tables in which the outward supplies details needs to be

captured. Based on the nature of business and the nature of supplies effected

during the month, only the relevant tables are applicable, not all. The GSTR-1

format in GST PORTAL is as follows:

How to file

GSTR-1 form?

The

GSTR-1 form consists of the following tables in which the details of outward

supplies need to be furnished by the registered businesses.

.jpeg)